TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

(RuleRULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant

☒Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material Pursuant to Rule 14a-12 |

L.B.

FOSTER COMPANYFoster Company

(Name of Registrant as Specified in Its Charter)(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ $125 per Exchange Act Rules O-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

☒ | | | No fee required: |

1)

| | | | | | |

☐ | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | | Title of each class of securities to which transaction applies: |

2)

| | | | | | |

| | | (2) | | | Aggregate number of securities to which transaction applies: |

3)

| | | | | | |

| | | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

4)

| | | | | | |

| | | (4) | | | Proposed maximum aggregate value of transaction: |

5)

| | | | | | |

| | | (5) | | | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

1)

| Amount Previously Paid:

| | | | | |

2)

☐ | | | Fee paid previously with preliminary materials. |

| | | | | | |

☐ | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | | Amount previously paid: |

| | | | | | |

| | | (2) | | | Form, Schedule or Registration Statement No.: |

3)

| Filing Party:

| | | | | |

4)

| Date Filed:

| | (3) | | | Filing Party: |

| | | | | | |

| | | (4) | | | Date Filed: |

| | | | | | |

TABLE OF CONTENTS

| |

| | | L.B. FOSTER COMPANY

415 Holiday Drive, Suite 100

Pittsburgh, Pennsylvania 15220

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY

23, 201928, 2020

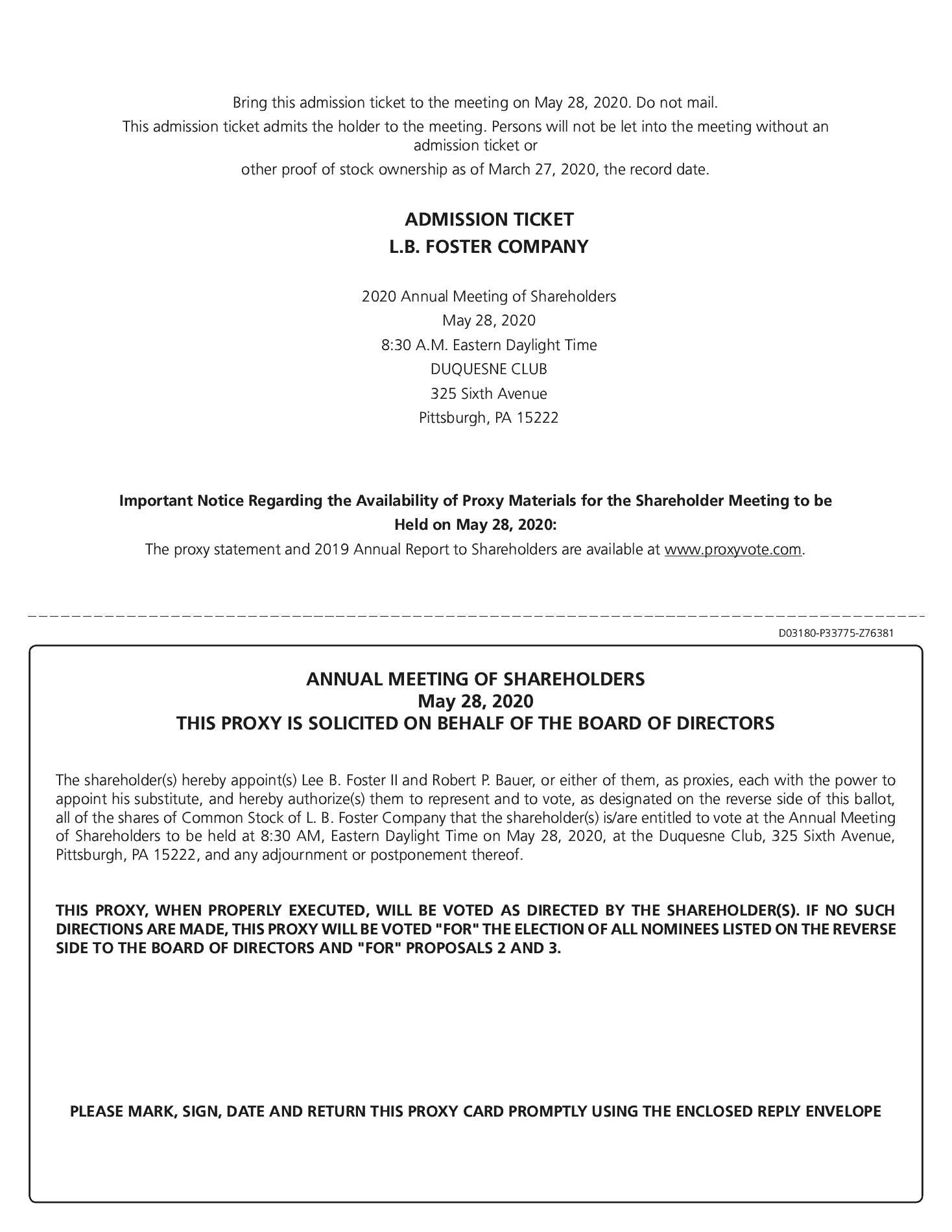

L.B. Foster Company (the “Company”) will hold its Annual Meeting of Shareholders at the Duquesne Club at 325 Sixth Avenue, Pittsburgh, Pennsylvania 15222 on Thursday, May

23, 2019,28, 2020, at 8:30 AM, Eastern Daylight Time (the “Annual Meeting” or the “Meeting”)

,. We intend to hold the Meeting in person; however, we are actively monitoring the outbreak of the COVID-19 coronavirus and are sensitive to health and travel concerns, as well as any restrictions governmental authorities may impose. In the event it is not possible or advisable to hold the Meeting in person, we will announce alternative arrangements as promptly as practicable, which may include holding the Meeting solely by means of remote communication. Please monitor the Company’s Proxy Materials Annual Meeting website at https://lbfostercompany.gcs-web.com/financial-information/proxy-materials on our website (www.lbfoster.com) for updated information. If you are planning on attending the Meeting in person, please check the website one week prior to the Meeting date. The Meeting will be held for the purposes of:

1.Electing a board of eight directors for the ensuing year;

2.Ratifying the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2019; and

3.Advisory approval of the compensation paid to the Company’s named executive officers in 2018.

1.

| Electing a board of eight directors for the ensuing year; |

2.

| Ratifying the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020; and |

3.

| Advisory approval of the compensation paid to the Company’s named executive officers in 2019. |

Shareholders will also be asked to consider and act upon such other business that properly comes before the Annual Meeting.

Shareholders are cordially invited to attend the Annual Meeting. Only holders of record of Company common stock at the close of business on March

21, 201927, 2020 will be entitled to vote at the Annual Meeting or at any adjournment or postponement thereof.

U.S. Securities and Exchange Commission rules allow companies to furnish proxy materials to their shareholders over the Internet. This process expedites shareholder receipt of proxy materials and lowers the cost of our Annual Meeting. On or about April

11, 2019,16, 2020, we mailed to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our

20192020 Proxy Statement and

20182019 Annual Report and how to cast your vote. The Notice also includes instructions on how to receive a paper copy of the Annual Meeting materials.

Your vote is important. Whether you plan to attend the Annual Meeting or not, we hope you will vote your shares as soon as possible. Please sign, date, and return your proxy card or voting instruction form or vote by telephone or via the Internet; instructions are included on the Notice, proxy card and voter instruction form. If you plan to attend the Annual Meeting in person, please detach the Admission Ticket from your proxy card and bring it to the Meeting. If you are a beneficial owner of shares held in “street name” through a broker, bank, or other intermediary, please contact your broker, bank, or other intermediary to obtain evidence of ownership and a legal proxy, which you must bring with you to the Meeting.

Patrick J. Guinee

Senior Vice President, General Counsel and

Corporate Secretary

| | | Patrick J. Guinee |

| | | Senior Vice President, General Counsel and |

| | | Corporate Secretary |

Pittsburgh, Pennsylvania

April 11, 2019

16, 2020

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains “forward-looking” statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Sentences containing words such as “believe,” “intend,” “plan,” “may,” “expect,” “should,” “could,” “anticipate,” “estimate,” “predict,” “project,” or their negatives, or other similar expressions of a future or forward-looking nature generally should be considered forward-looking statements. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018.2019. We undertake no responsibility to publicly update or revise any forward-looking statement except as required by applicable law.

TABLE OF CONTENTS

L.B. FOSTER COMPANY

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of L.B. Foster Company (the “Company”) to be voted at the May

23, 201928, 2020 Annual Meeting of Shareholders and at any adjournment or postponement thereof (the “Annual Meeting” or the “Meeting”). This Proxy Statement, the Notice of Internet Availability of Proxy Materials, the proxy card, and our

20182019 Annual Report to Shareholders were each made available to shareholders on the Internet, free of charge, at

www.proxyvote.com or mailed on or about April 11, 2019.16, 2020.

At the close of business on March

21, 2019,27, 2020, the record date for entitlement to vote at the Meeting (the “Record Date”), there were

10,581,28110,706,507 shares of common stock outstanding. Only holders of record of our common stock at the close of business on the Record Date are entitled to notice of, and to vote at, the Meeting or at any adjournment or postponement thereof. Such shareholders will have one vote for each share held on that date.

The presence, in person or by proxy, of the shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a matter to be acted on at the Annual Meeting will constitute a quorum. Where a shareholder’s proxy or ballot is properly executed and returned but does not provide voting instructions, the shares of such shareholder will nevertheless be counted as being present at the Meeting for the purpose of determining a quorum. Abstentions and “broker non-votes” (as described below) will be counted for purposes of determining a quorum.

If your shares are held in “street name” (i.e. held for your account by a broker or other nominee), you should receive instructions from the holder of record on voting your shares. If a shareholder holds shares beneficially in street name and does not provide the shareholder’s broker with voting instructions, such shares may be treated as “broker non-votes.” Generally, broker non-votes occur when a broker is not permitted to vote on a particular matter without instructions from the beneficial owner and instructions have not been given. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals, such as the election of directors and executive compensation matters (for purposes of this Proxy Statement, Proposals 1 and 3), although they may vote their clients’ shares on “routine” proposals, such as the ratification of the independent registered public accounting firm (for purposes of this Proxy Statement, Proposal 2). In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal.

Directors will be elected by a plurality of the votes cast by the holders of the shares voting in person or represented by proxy at the Meeting. Only votes FOR or AGAINST the election of each director nominee under Proposal 1 count as votes cast. Abstentions and broker non-votes are not considered to be votes cast for each director nominee under Proposal 1. Our common stock does not have cumulative voting rights in the election of directors.

The Audit Committee of the Board has appointed Ernst & Young LLP (“Ernst & Young”) as the Company’s independent registered public accounting firm for 2019.2020. The affirmative vote of a majority of the votes cast by the Company’s shareholders entitled to vote shall ratify this appointment. Only votes FOR or AGAINST this proposal count as votes cast. Abstentions and broker non-votes are not considered to be votes cast on this proposal.

The advisory vote to approve the compensation paid to the Company’s named executive officers in

20182019 as reported in this Proxy Statement will be determined by the affirmative vote of a majority of the votes cast by the Company’s shareholders entitled to vote. Only votes FOR or AGAINST this proposal count as votes cast. Abstentions and broker non-votes are not considered to be votes cast on this proposal.

If you are a shareholder of record and your form of proxy is properly executed and returned, it will be voted as directed. If no directions are given, the proxy will be voted FOR the election of the eight nominees named herein as directors; FOR the ratification of the appointment of Ernst & Young as the Company’s independent registered public accounting firm for 2019;2020; and FOR the approval of the compensation paid to the Company’s named executive officers in 20182019 as reported in this Proxy Statement. The proxy grants discretionary authority to vote on other matters

TABLE OF CONTENTS

that properly come before the Annual Meeting

(including to adjourn the Meeting) to Lee B. Foster II, Chairman of the Board, and Robert P. Bauer, President and Chief Executive Officer.

The voting instruction form also serves as the voting instructions for the trustees who hold shares of record for participants in the Company’s 401(k) plans. If voting instructions representing shares in the Company’s 401(k) plans are received, but no indication is provided as to how those shares are to be voted, the shares will be counted as being present at the Meeting and will count toward achievement of a quorum. If voting instructions as to the shares in the Company’s 401(k) plans are not received, those shares will be voted in the same proportion as shares in the 401(k) plans for which voting instructions were received.

The cost of soliciting proxies will be borne by the Company. Officers or employees of the Company may solicit proxies by mail, telephone, email, or facsimile. The Company has retained Laurel Hill Advisory Group, LLC for the solicitation of proxies and will pay its fee of $5,500 plus reasonable out-of-pocket expenses.

If you are a shareholder of record, you may vote your shares of Company common stock by telephone or through the Internet. You may also vote your shares by mail or in person. Please see the Notice of Internet Availability of Proxy Materials for instructions on how to access the proxy materials and how to cast your vote.

Votes submitted via the Internet or by telephone must be received by 11:59 PM EDT, on May 22, 2019.27, 2020. Submitting your vote via the Internet or by telephone will not affect your right to vote in person should you decide to attend the Annual Meeting. You may change your vote or revoke your proxy at any time by submitting a valid, subsequent vote by telephone or through the Internet, by submitting another properly signed proxy which bears a later date, or attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not by itself revoke a previously granted proxy; you must also vote your shares.

If you plan on attending the Annual Meeting in person, please detach the Admission Ticket from your proxy card and bring it to the Meeting. If you are a beneficial owner of shares held in “street name” through a broker, bank, or other intermediary, please contact your broker, bank, or other intermediary to obtain evidence of ownership and a legal proxy, which you must bring with you to the Meeting.

TABLE OF CONTENTS

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The first proposal item to be voted on is the election of eight directors. The Board of Directors has nominated the following eight people to serve as directors, all of whom are currently serving as directors of the Company. Each director who is elected will hold office until the next annual meeting and generally until the director’s successor is elected and qualified. Information concerning the nominees is set forth below with brief descriptions of each nominee’s qualifications to serve on the Company’s Board of Directors:

Nominee

| | |

Nominee

|

|

|

|

| |

Robert P. Bauer

| | | Mr. Bauer, age 60,61, has been a director of the Company since February 2012, when he was appointed President and Chief Executive Officer. Since August 2015, Mr. Bauer has served as a director of Alamo Group, Inc., which designs, manufactures, distributes, and services equipment for infrastructure maintenance, agriculture, and other applications, including truck and tractor mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, and other industrial equipment. At Alamo Group, Mr. Bauer serves on the nomination and governance, compensation, and audit committees. Mr. Bauer served as President of Emerson Climate Technologies, Refrigeration Division, a business segment of Emerson Electric Co., a diversified global manufacturing and technology company, (“Emerson”) from June 2011 to February 2012. He also served as President of Emerson Network Power, Liebert Division, from January 2002 through May 2011. Mr. Bauer spent a total of 17 years with Emerson in various senior management positions and became a Group Vice President, Emerson in 2004. Prior to Emerson, he held management positions with Rockwell Automation and Westinghouse Electric.

Qualifications. We believe that Mr. Bauer is qualified to serve as a director because of his vast experience in global manufacturing, worldwide marketing, and new product development. He also has extensive experience with mergers and acquisitions and strategic planning including investments in new technologies.

|

| | | |

Lee B. Foster II

| | | Mr. Foster, age 72,73, has been a director of the Company since 1990 and Chairman since 1998. He was the Chief Executive Officer of the Company from May 1990 until he resigned from such office in January 2002 and remained a Company employee until May 2008. Since 1999, Mr. Foster has been a director of Wabtec Corporation, which manufactures components for locomotives, freight cars, and passenger transit vehicles and provides aftermarket services.services, and he serves on the compensation and audit committees of that company.

Qualifications. We believe that Mr. Foster is qualified to serve as a director because of his history with the Company and his knowledge of the Company’s current businesses, as well as his corporate governance experience as a member of another public company’s board of directors. In addition, Mr. Foster’s experience brings additional insight to a variety of our business issues. |

| | |

| | |

Nominee

|

|

|

|

| |

Dirk Jungé

| | | Mr. Jungé, age 70,71, has been a director of the Company since 2015. He has beenwas the Chairman of Pitcairn Company, a private Pitcairn family holding company, and Pitcairn Trust Company, a Pennsylvania state-chartered trust company, since 1991.from 1991 to 2019. Until 2012, he served as Chief Executive Officer of Pitcairn, a recognized global leader in the specialized family office marketplace and has overseen investments in oil and gas and drilling partnerships. Since 2000, he has served as a director of Paramount Resources, Ltd., a public Canadian energy company, with assignments on the corporate governance committee since 2003 and the environmental, health & safety committee since 2011, which he currently chairs. InFrom 2013 to 2019, he joinedserved the Board of Directors of Freeman Company, a privately-held company and a leader in face-to-face marketing, and currently serves as the Chairman ofwhere he chaired its compensation committee. Mr. Jungé is also a credentialed Chartered Financial Analyst. Since 2012, he has served as Chair of the Aviation Council of Pennsylvania.

|

TABLE OF CONTENTS

| | |

Qualifications. We believe that Mr. Jungé is qualified to serve as a director because of his years of business experience, including in the energy sector and in public and private enterprises, as well as his familiarity with strategic planning, risk management, compensation, finance, and governance matters, which enable him to make a valuable contribution to the Board’s business and compliance oversight functions.

|

| | | |

Diane B. Owen

| | | Ms. Owen, age 63,64, was elected as a director of the Company in May 2002. SheFrom 2014 to 2019, she served as an independent Board Membermember and Internal Control Committee Chairinternal control committee chair of Elliott Group Holdings, a subsidiary of Ebara Corporation, an international company that manufactures and services industrial equipment, from June 2014 to March 2019.equipment. She was Senior Vice President – Corporate Audit of H.J. Heinz Company, an international food company, from May 2010 to June 2013 and was Vice President - Corporate Audit of H.J. Heinz Company from April 2000 to May 2010.

Qualifications. We believe that Ms. Owen is qualified to serve as a director of the Company due to her over 30 years of business experience, particularly in accounting and finance. Ms. Owen plays a critical role as Chairman of the Audit Committee and as the Board’s audit committee financial expert. In addition, Ms. Owen’s extensive international business experience enables her to provide valuable insights to the Company in its international business interests.

|

| | |

| | |

Nominee

|

|

|

|

| |

Robert S. Purgason

| | | Mr. Purgason, age 63,64, has been a director of the Company since December 2014. Since November 2018, he has served as a director of Altus Midstream Company, a natural gas gathering, processing, and transmission company, where he sits on the compensation committee, and has also been a principal of Wildfork Midstream, LLC, which acquires and operates midstream oil and gas assets, since August 2018.assets. He served as Senior Managing Director of Kayne Anderson Capital Advisors, LLC, a registered investment advisory company, from March 2017 to November 2018. He was Senior Vice President of The Williams Companies (“Williams”) from January 2015 through Februaryto 2017, leading the Williams operating area that encompasses the assets and operations of Access Midstream, including natural gas gathering and processing. During that period, Mr. Purgason was a director of Williams Partners, and also served as Chief Operating Officer of the general partner of Access Midstream from 2012 to 2015. Prior to joining Access Midstream, Mr. Purgason spent five years at Crosstex Energy Services, L.P. and was promoted to Senior Vice President-Chief Operating Officer in November 2006. Prior to Crosstex, Mr. Purgason spent 19 years with The Williams Companies in various senior business development and operational roles of increasing responsibility. Mr. Purgason began his career at Perry Gas Companies in Odessa, Texas working in all facets of the natural gas treating business.

Qualifications. We believe that Mr. Purgason is qualified to serve as a director of the Company because of his extensive experience in, and keen understanding of, the energy industry bringing valuable insight to the Board, particularly with regard to the Company’s operations which include pipe threading and coating as well as blending, injection, and custody transfer metering skids for the oil and gas industry. He also brings board experience which contributes to the corporate governance experience of the Board.

|

| | | |

William H. Rackoff

| | | Mr. Rackoff, age 70,71, has been a director of the Company since 1996. He has served as President of Andritz Asko, Inc., an international company which manufactures custom engineered tooling for the metalworking industry, sincefrom September 2018, when ASKO, Inc. was acquired by the Andritz AG, an international technology company and supplier of plants, equipment, and services to hydropower stations, the pulp and paper industry, the metalworking and steel industries, and for solid/liquid separation in the municipal and industrial segments.segments, through March 2020. Prior to its acquisition by Andritz, Mr. Rackoff was President and Chief Executive Officer of ASKO, Inc. since 1994.

|

TABLE OF CONTENTS

| | |

Qualifications. We believe that Mr. Rackoff is qualified to serve as a director of the Company because of his years of experience in the steel industry and his engineering background which enable him to understand and develop the factors that drive the Company’s performance, including strategy, operations, and finance. Mr. Rackoff, as former Chairman of the Compensation Committee, has led the design and development of the Company’s executive incentive programs.

|

| | |

| | |

Nominee

|

|

|

|

| |

Suzanne B. Rowland

| | | Ms. Rowland, age 57,58, has been a director of the Company since May 2008. Ms. RowlandShe is the former Group Vice President, Industrial Specialties at Ashland Global Holdings, Inc. , a position she held from June 2016 through Marchto 2019 during the final phase of transformation from a holding company to a specialty chemicals company. Previously, she held senior executive positions at Tyco International from 2009 to 2015 and with Rohm and Haas Company for over 20 years. She joined the Board of Directors at SPXFLOW, Inc., a global supplier of advanced process equipment into food, beverage, and industrial markets, in November 2018 and serves on its audit, compensation, and nomination and governance committees. She currently serves as an Overseer of the University of Pennsylvania School of Engineering and Applied Science.

Qualifications. We believe that Ms. Rowland is qualified to serve as a director of the Company because of her broad leadership experience in Fortune 500 global companies. Having served as an operating executive for the last 21 years in chemical, materials, and mechanical and electrical products, Ms. Rowland brings valuable insight into strategic and operational issues important to the Company’s success.

|

| | | |

Bradley S. Vizi

| | | Mr. Vizi, age 35,36, has been a director of the Company since February 2016. He has been Executive Chairmana director of RCM Technologies, Inc., a public professional staffing and solutionspublicly traded human capital management company, since June2013. In 2018, havinghe became Executive Chairman and President of RCM, and was previously served as Chairman of the Board of RCM since 2015 and has been a member and on the compensation and governance committees and has been a member of that Board since 2013. He is also the Chief Investment Officer of Convoy Capital, a Los Angeles-based firm specializing in small-cap activism since October 2017.company. Prior to October 2017, Mr. Vizi was Managing Director of Legion Partners Asset Management, a registered investment advisor, where he served in that capacity since 2012. Prior to founding Legion Partners, Mr. Vizi was an investment professional for Shamrock Capital Advisors, the alternative investment vehicle of the Disney Family from 2007 to 2010. Prior to Shamrock, Mr. Vizi was a member of the private equity group at Kayne Anderson Capital Advisors.

Qualifications. We believe that Mr. Vizi is qualified to serve as a director of the Company because of his public company CEO experience, valuable understanding of capital allocation and public markets, experience in compensation and corporate governance matters, and shareholder perspective regarding enhancing stakeholder value.

|

The Board nominated the foregoing nominees based upon the recommendation of the Nomination and Governance Committee. The nominees have expressed their willingness to serve as directors, if elected. However, should any of the nominees be unavailable for election, the proxies (except for proxies that withhold authority to vote for directors) will be voted for such substitute nominee or nominees as may be chosen by the Board, or the number of directors may be reduced by appropriate action of the Board.

The Board of Directors recommends that you vote “FOR” each of the foregoing nominees.

TABLE OF CONTENTS

PROPOSAL NO. 2 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ernst & Young LLP

has served as the Company’s independent registered public accounting firm since 1990 and has been appointed by the Audit Committee of the Board as the Company’s independent registered public accounting firm for the fiscal year ending December 31,

2019.2020. Although the Audit Committee has the sole authority to appoint the Company’s independent registered public accounting firm, as a matter of good corporate governance, the Board is seeking shareholder ratification of this appointment. If the shareholders fail to ratify the selection, the Audit Committee will

consider the appointment.take this into consideration. Even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different firm at any time during the year if the committee determines that such a change would be in the best interests of the Company and its shareholders. Representatives of Ernst & Young are expected to be in attendance at the meeting to respond to appropriate questions from shareholders and will have an opportunity to make a statement if they so desire.

The Board of Directors recommends that you vote “FOR” ratification of Ernst & Young LLP’s appointment as the Company’s independent registered public accounting firm for fiscal year

2019.2020.

PROPOSAL NO. 3 - ADVISORY VOTE ON NAMED EXECUTIVE OFFICERS’ 2018 COMPENSATION2019 COMPENSATION

At the 2011 and 2017 Annual Meetings, upon recommendation by the Board of Directors, shareholders voted to hold an advisory vote on executive compensation every year.

Accordingly, the Company has determined to submit an advisory vote on our executive compensation program to shareholders at each annual meeting, with the next one occurring in 2021, until the Company seeks another advisory vote on the frequency of the executive compensation advisory vote, which is expected to occur in 2023.

The following proposal gives our shareholders the opportunity to vote to approve or not approve, on an advisory basis, the compensation paid to our named executive officers in

2018,2019, as described in this Proxy Statement, and is non-binding upon the Company, our Board, or the Compensation Committee of the Board. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our executive officers and our compensation philosophy, policies, and practices, as disclosed under the “Executive Compensation” section of this Proxy Statement. We are providing this vote as required by Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, we are asking our shareholders to vote “FOR” the adoption of the following resolution:

“

RESOLVED, that the compensation paid to the named executive officers of L.B. Foster Company (the “Company”), as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion in the Company’s Proxy Statement for the 20192020 Annual Meeting of Shareholders under the heading entitled ‘Executive Compensation,’ is hereby approved.”The Company’s compensation programs are centered on a pay-for-performance culture and are strongly aligned with the long-term interests of shareholders. The Company’s goal for its executive compensation program is to reward executives who provide leadership for, and contribute to, the Company’s financial success.

While we intend to carefully consider the voting results of this proposal, the final vote is advisory in nature and therefore not binding on the Company, our Board, or the Compensation Committee of the Board.

The Board of Directors recommends that you vote “FOR” approval of the named executive officers’

compensation in 2018,2019, as reported in this Proxy Statement.

TABLE OF CONTENTS

The following table shows the number of shares of common stock beneficially owned on the Record Date by:

•

each person who has reported beneficial ownership of more than 5% of the Company’s common stock;

•

each current director and nominee for director;

•each Named Executive Officer (“NEO”) included in the Summary Compensation Table on page 40; and

•

| • | each Named Executive Officer (“NEO”) included in the Summary Compensation Table on page 32; and |

all directors and executive officers as a group.

Information concerning persons we know to be the beneficial owners of more than 5% of the Company’s outstanding common stock is based upon reports filed with the Securities and Exchange Commission (“SEC”).

More Than 5% Shareholders:

| | | | | | |

Legion Group(d) | | | 1,046,101 | | | 9.8% |

BlackRock, Inc.(e) | | | 718,590 | | | 6.7% |

Dimensional Fund Advisors LP(f) | | | 638,996 | | | 6.0% |

Renaissance Technologies(g) | | | 719,199 | | | 6.7% |

| | | | | | |

Nominees for Director:

| | | | | | |

Robert P. Bauer (CEO) | | | 160,838 | | | 1.5% |

Lee B. Foster II | | | 202,614 | | | 1.9% |

Dirk Jungé | | | 10,516 | | | * |

Diane B. Owen | | | 46,771 | | | * |

Robert S. Purgason | | | 41,387 | | | * |

William H. Rackoff | | | 67,339 | | | * |

Suzanne B. Rowland | | | 22,517 | | | * |

Bradley S. Vizi | | | 3,171 | | | * |

| | | | | | |

Named Executive Officers (other than CEO):

| | | | | | |

James P. Maloney | | | 21,964 | | | * |

John F. Kasel | | | 61,644 | | | * |

Gregory W. Lippard | | | 34,667 | | | |

Patrick J. Guinee | | | 37,237 | | | * |

| | | | | | |

All Directors and Executive Officers as a Group (15 persons) | | | 710,665 | | | 6.6% |

| | | | | |

Stock Ownership | | Number of Shares Owned(a) | | Percent of Shares(b)(c) |

| | | | | |

More Than 5% Shareholders: | | | | | |

Legion Group(d) | | 1,052,002 | | 9.9 | % |

BlackRock, Inc.(e) | | 638,964 | | 6.0 | % |

Dimensional Fund Advisors LP(f) | | 662,448 | | 6.3 | % |

| | | | | |

Nominees for Director: | | | | | |

Robert P. Bauer (CEO) | | 109,391 | | 1.0 | % |

Lee B. Foster II | | 202,614 | | 1.9 | % |

Dirk Jungé | | 10,516 | | * | |

Diane B. Owen | | 43,769 | | * | |

Robert S. Purgason | | 38,340 | | * | |

William H. Rackoff | | 64,263 | | * | |

Suzanne B. Rowland | | 22,517 | | * | |

Bradley S. Vizi | | 3,171 | | * | |

| | | | | |

Named Executive Officers (other than CEO): | | | | | |

James P. Maloney | | 9,784 | | * | |

John F. Kasel | | 51,236 | | * | |

Patrick J. Guinee | | 25,363 | | * | |

Gregory W. Lippard | | 26,972 | | * | |

| | | | | |

All Directors and Executive Officers as a Group (15 persons) | | 660,977 | | 6.2 | % |

________________

*Less than 1% of the Company’s outstanding common stock

(a)This column shows the number of shares with respect to which the named person or group had direct or indirect sole or shared voting or investment power. Unless otherwise noted in the footnotes, each director and NEO has sole voting and investment power with respect to their shares. The column also includes the shares allocated to accounts in the 401(k) plan maintained by the Company (5,973 for Mr. Bauer, 0 for Mr. Maloney, 5,911 for Mr. Kasel, 0 for Mr. Guinee, 1,531 for Mr. Lippard, and 531 for the other executive officers as a group). Mr. Bauer’s holdings

*

| Less than 1% of the Company’s outstanding common stock based on 10,706,507 shares of Company Common Stock outstanding on March 27, 2020. |

(a)

| This column shows the number of shares with respect to which the named person or group had direct or indirect sole or shared voting or investment power. Unless otherwise noted in the footnotes, each director and NEO has sole voting and investment power with respect to their shares. The column also includes the shares allocated to accounts in the 401(k) plan maintained by the Company (6,331 for Mr. Bauer, 0 for Mr. Maloney, 5,908 for Mr. Kasel, 1,531 for Mr. Lippard, 0 for Mr. Guinee, and 531 for the other executive officers as a group). Mr. Bauer’s holdings include 7,000 shares which are held in trust; Mr. Foster’s holdings include 5,000 shares in a 401(k) plan maintained by a separate company, 17,000 shares which are held in an individual retirement account, and 160,726 shares which are held in trust; Ms. Rowland’s holdings include 1,000 shares held in an IRA; and Mr. Jungé’s holdings include 10,516 shares held in trust. As of May 2017, all Directors were permitted to elect to receive their quarterly cash fees and annual stock award in deferred stock units that would vest six months after their date of separation from the Board. The shareholdings reflected in this column do not include any deferred stock units, which may not be settled for shares of common stock until six months after termination of service from the Board and confer no voting or other shareholder rights upon the director. The deferred stock unit holdings are as follows: Mr. Foster 14,953 deferred units; Mr. Jungé 12,404 deferred units; Mr. Rackoff 7,206 deferred units; Ms. Rowland 10,282 deferred units; and Mr. Vizi 9,202 deferred units. |

(b)

| For Directors and Executive Officers, the percentages in this column are based on the assumption that any shares which the named person has the right to acquire within 60 days after the Record Date have been acquired and are outstanding. |

(c)

| Based on 10,706,507 shares of the Company’s common stock outstanding on March 27, 2020. |

(d)

| The information is based on a Schedule 13D/A filed jointly by Legion Partners, L.P. I (“Legion Partners I”), Legion Partners, L.P. II (“Legion Partners II”), Legion Partners Special Opportunities, L. P. II (“Legion Special II”), Legion Partners, LLC (“Legion Partners”), |

include 7,000 shares which are held in trust; Mr. Foster’s holdings include 5,000 shares in a 401(k) plan maintained by a separate company, 17,000 shares which are held in an individual retirement account, and 160,726 shares which are held in trust; Ms. Rowland’s holdings include 1,000 shares held in an IRA; and Mr. Jungé’s holdings include 10,516 shares held in trust. As of May 2017, all Directors were permitted to elect to receive their quarterly cash fees and annual stock award in deferred stock units that would vest six months after their date of separation from the Board. The shareholdings reflected in this column do not include any deferred stock units, which may not be settled for shares of common stock until six months after termination of service from the Board and confer no voting or other shareholder rights upon the director. The deferred stock unit holdings are as follows: Mr. Foster 11,877 deferred units; Mr. Jungé 9,328 deferred units; Mr. Rackoff 7,206 deferred units; Ms. Rowland 7,206 deferred units; and Mr. Vizi 6,157 deferred units.TABLE OF CONTENTS

(b)For Directors and Executive Officers, the percentages in this column are based on the assumption that any shares which the named person has the right to acquire within 60 days after the Record Date have been acquired and are outstanding.

(c)Based on 10,581,281 shares of the Company’s common stock outstanding on March 21, 2019.

(d)The information is based on a Schedule 13D/A filed by Legion Partners, L.P. I (“Legion Partners I”), Legion Partners, L.P. II (“Legion Partners II”), Legion Partners Special Opportunities, L. P. II (“Legion Special II”), Legion Partners, LLC (“Legion Partners”), Legion Partners Asset Management, LLC (“Legion Asset Management”), Legion Partners Holdings, LLC (“Legion Holdings”), Christopher S. Kiper and Raymond White (collectively, the “Legion Group”) on

August 16, 2018January 10, 2020 with the SEC, reporting beneficial ownership as of

August 15, 2018.January 10, 2020. Legion Partners I has sole voting and dispositive power with respect to 0 shares and shared voting and dispositive power with respect to 610,733 shares. Legion Partners II has sole voting and dispositive power with respect to 0 shares and shared voting and dispositive power with respect to 105,757 shares. Legion Special II has sole voting and dispositive power with respect to 0 shares and shared voting and dispositive power with respect to

324,114318,213 shares. Legion Partners has sole voting and dispositive power with respect to 0 shares and shared voting and dispositive power with respect to

1,040,6041,034,703 shares. Legion Asset Management, Legion Holdings, and Messrs. Kiper and White have sole voting and dispositive power with respect to 0 shares and shared voting and dispositive power with respect to

1,052,0021,046,101 shares. As the general partner of each of Legion Partners I, Legion Partners II and Legion Special II, Legion Partners may be deemed to be the beneficial owner of the shares owned by each. Legion Asset Management, as the investment advisor of each of Legion Partners I, Legion Partners II and Legion Special II, may be deemed the beneficial owner of the shares owned by Legion Partners I, Legion Partners II and Legion Special II. Legion Holdings, as the sole member of Legion Asset Management and managing member of Legion Partners, may be deemed the beneficial owner of the shares owned by Legion Partners I, Legion Partners II,

Legion Special II, and Legion

Special II.Asset Management. Each of Messrs. Kiper and White, as managing directors of Legion Asset Management and a managing member of Legion Holdings, respectively, may be deemed the beneficial owners of the shares owned by Legion Partners I, Legion Partners II, Legion Partners Special II and Legion Asset Management. The

Investor Agreement with the Legion Group terminated fully in February 2018. The address for each reporting person is

940112121 Wilshire Blvd,

Suite 705, Beverly Hills,Suit 1240, Los Angeles, CA

90212.(e)The information is based on a Schedule 13G filed by BlackRock, Inc. with the SEC on February 8, 2019, reporting beneficial ownership as of December 31, 2018. BlackRock, Inc. reported that it has sole voting power with respect to 617,894 shares of the Company’s common stock, sole dispositive power with respect to 638,964 shares of the Company’s common stock and shared voting or dispositive power with respect to 0 shares. The address for the reporting person is 55 East 52nd Street, New York, NY 10055.

(f)The information is based on a Schedule 13G/A filed by Dimensional Fund Advisors LP with the SEC on February 8, 2019, reporting beneficial ownership as of December 31, 2018. Dimensional Fund Advisors LP reported that it has sole voting power with respect to 620,168 shares of the Company’s common stock, sole dispositive power with respect to 662,448 shares of the Company’s common stock, and shared voting or dispositive power with respect to 0 shares. The address for the reporting person is Building One, 6300 Bee Cave Road, Austin, TX 78746.

90025.(e)

| The information is based on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on February 5, 2020, reporting beneficial ownership as of December 31, 2019. BlackRock, Inc. reported that it has sole voting power with respect to 700,119 shares, sole dispositive power with respect to 718,590 shares and shared voting and dispositive power with respect to 0 shares. The address for the reporting person is 55 East 52nd Street, New York, NY 10055. |

(f)

| The information is based on a Schedule 13G/A filed by Dimensional Fund Advisors LP with the SEC on February 12, 2020, reporting beneficial ownership as of December 31, 2019. Dimensional Fund Advisors LP reported that it has sole voting power with respect to 600,181 shares, sole dispositive power with respect to 638,996 shares, and shared voting or dispositive power with respect to 0 shares. The address for the reporting person is Building One, 6300 Bee Cave Road, Austin, TX 78746. |

(g)

| The information is based on a Schedule 13G filed jointly by Renaissance Technologies LLC and Renaissance Technology Holdings Corporation (collectively, “Renaissance Technologies”) with the SEC on February 12, 2020, reporting beneficial ownership as of February 19, 2019. Renaissance Technologies Holdings Corporation is the majority owner of Renaissance Technologies, LLC. Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation each reported sole voting power with respect to 703,908 shares, sole dispositive power with respect to 717,341 shares, shared voting power with respect to 0 shares, and shared dispositive power with respect to 1,858 shares, resulting in total beneficial ownership of 719,199 shares. The address for the reporting person is 800 Third Avenue, New York, New York 10022. |

TABLE OF CONTENTS

DIRECTOR COMPENSATION –

20182019

The following table sets forth our non-employee director compensation for 2018.2019. Directors who are also employees of the Company do not receive any consideration for their service on the Board.

Lee B. Foster II | | | $120,000 | | | $75,000 | | | $195,000 |

Dirk Jungé | | | $60,000 | | | $75,000 | | | $135,000 |

Diane B. Owen | | | $70,000 | | | $75,000 | | | $145,000 |

Robert S. Purgason | | | $66,250 | | | $75,000 | | | $141,250 |

William H. Rackoff | | | $66,250 | | | $75,000 | | | $141,250 |

Suzanne B. Rowland | | | $66,000 | | | $75,000 | | | $141,000 |

Bradley S. Vizi | | | $60,000 | | | $75,000 | | | $135,000 |

| | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash ($)1,2 | | Stock

Awards ($)3 | | Total ($) |

Lee B. Foster II | | $ | 117,500 | | | $ | 75,000 | | | $ | 192,500 | |

Dirk Jungé | | $ | 57,500 | | | $ | 75,000 | | | $ | 132,500 | |

Diane B. Owen | | $ | 67,500 | | | $ | 75,000 | | | $ | 142,500 | |

Robert S. Purgason | | $ | 57,500 | | | $ | 75,000 | | | $ | 132,500 | |

William H. Rackoff | | $ | 70,000 | | | $ | 75,000 | | | $ | 145,000 | |

Suzanne B. Rowland | | $ | 63,500 | | | $ | 75,000 | | | $ | 138,500 | |

Bradley S. Vizi | | $ | 57,500 | | | $ | 75,000 | | | $ | 132,500 | |

________________

1On February 23, 2017, the Board of Directors approved a decrease in the non-employee directors annual fee established on May 29, 2015, from $55,000 to $50,000. This caused the annual directors retainer fees to be reduced to the following amounts: $110,000 for the Chairman of the Board; $62,500 for the Chair of the Compensation Committee; $60,000 for the Chair of the Audit Committee; and $56,000 for the Chair of the Nomination and Governance Committee. On February 22, 2018, the Board of Directors approved an increase in the non-employee directors annual fee from $50,000 to $60,000, resulting in the following annual director retainer fees: Chairman of the Board, $120,000; Chair of Compensation Committee, $72,500; Chair of Audit Committee, $70,000; and Chair of Nomination and Governance Committee, $66,000.

2On May 1, 2017, the Board of Directors approved the Non-Employee Director Deferred Compensation Plan (the “Director Deferred Compensation Plan”), which permits participants to elect to defer receipt of their cash and/or equity compensation to a date that is six months after separation from the Board. Since February 25, 2016, non-employee directors have been permitted to make discretionary elections to receive annual cash retainer fees in fully-vested shares of common stock on a quarterly basis or in quarterly installments of cash. Under the Director Deferred Compensation Plan, in lieu of receiving cash fees on a quarterly basis, non-employee directors may make an irrevocable election for each Board year (commencing on the date of each Annual Meeting of Shareholders through the following Annual Meeting of Shareholders) to receive, at his or her sole discretion, all of such director’s annual cash retainer fees in the form of either (i) fully-vested Common Stock, (ii) deferred stock units, or (iii) deferred cash. The cash retainer is divided by four and either (i) with respect to fully-vested Common Stock, issued on each quarterly payment date, with the number of shares determined by dividing the applicable quarterly cash retainer fee by the closing market price per share of the Company’s Common Stock; (ii) with respect to deferred stock units, determined by dividing the applicable quarterly cash retainer fee by the closing market price per share of the Company’s Common Stock and crediting that number of units to the director’s deferred stock account; or (iii) credited to a deferred cash account with interest calculated at the U.S. Prime Rate. Commencing on the date of the May 2017 Annual Meeting of Shareholders, Messrs. Foster, Jungé, and Vizi elected to receive their cash retainers in deferred stock units and the remaining directors elected to receive their cash retainers in cash. Commencing on the date of the May 2018 Annual Meeting of Shareholders, all directors elected to receive their cash retainers in cash. The amounts of retainer fees paid in cash, fully-vested stock, and deferred stock units in 2018 are as follows: Mr. Foster received $90,000 in cash, $0 in fully-vested stock, and $27,500 in deferred stock units; Mr. Jungé received $45,000 in cash, $0 in fully-vested stock, and $12,500 in deferred stock units; Ms. Owen received $67,500 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Mr. Purgason received $57,500 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Mr. Rackoff received $70,000 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Ms. Rowland received $63,500 in cash, $0 in fully-vested stock, and $0 in deferred stock units; and Mr. Vizi received $45,000 in cash, $0 in fully-vested stock, and $12,500 in deferred stock units. No director elected to defer cash fees into a deferred cash account.

3On May 24, 2018, each non-employee director serving at that time was awarded an amount of shares of the Company’s Common Stock equal to $75,000 divided by the closing share price per share on the Nasdaq Stock Market on that date, with such shares vesting on the one-year anniversary of the grant date. As with the annual cash retainer fees, under the Director Deferred Compensation Plan, non-employee directors may make an irrevocable election for each Board year (commencing on the date of each Annual Meeting of Shareholders through the following Annual Meeting of Shareholders) to receive, at his or her sole discretion, all of such director’s annual stock award in the form of deferred stock units which would not vest until six months after the respective director’s separation from the Board, subject to the one-year vesting schedule established at grant. Messrs. Foster, Jungé, and Rackoff and Ms. Rowland elected to receive their annual stock award, which amounted to 3,171 shares, in deferred stock units. Ms. Owen and Messrs. Purgason and Vizi received awards of 3,171 shares on the grant date which are only subject to the one-year vesting period. The stock awards are reflected in the “Stock Awards” column of the table and computed in accordance with FASB ASC Topic 718 (excluding the effect of estimated forfeitures). For a discussion of valuation assumptions, see Note 15 of the Company’s Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

1

| On February 22, 2018, the Board of Directors approved an annual cash retainer fee of $60,000 for each non-employee director, and the following additional annual director retainer fees: Chairman of the Board, $60,000; Chair of Compensation Committee, $12,500; Chair of Audit Committee, $10,000; and Chair of Nomination and Governance Committee, $6,000. This compensation was unchanged in 2019. |

2

| On May 1, 2017, the Board of Directors approved the Non-Employee Director Deferred Compensation Plan (the “Director Deferred Compensation Plan”), which permits participants to elect to defer receipt of their cash and/or equity compensation to a date that is six months after separation from the Board. Since February 25, 2016, non-employee directors have been permitted to make discretionary elections to receive annual cash retainer fees in fully-vested shares of common stock on a quarterly basis or in quarterly installments of cash. Under the Director Deferred Compensation Plan, in lieu of receiving cash fees on a quarterly basis, non-employee directors may make an irrevocable election for each Board year (commencing on the date of each Annual Meeting of Shareholders through the following Annual Meeting of Shareholders) to receive, at his or her sole discretion, all of such director’s annual cash retainer fees in the form of either (i) fully-vested Common Stock, (ii) deferred stock units, or (iii) deferred cash. The cash retainer is divided by four and either (i) with respect to fully-vested Common Stock, issued on each quarterly payment date, with the number of shares determined by dividing the applicable quarterly cash retainer fee by the closing market price per share of the Company’s Common Stock; (ii) with respect to deferred stock units, determined by dividing the applicable quarterly cash retainer fee by the closing market price per share of the Company’s Common Stock and crediting that number of units to the director’s deferred stock account; or (iii) credited to a deferred cash account with interest calculated at the U.S. Prime Rate. Commencing on the date of the May 2017 Annual Meeting of Shareholders, Messrs. Foster, Jungé, and Vizi elected to receive their cash retainers in deferred stock units and the remaining directors elected to receive their cash retainers in cash. Commencing on the date of the May 2018 Annual Meeting of Shareholders, all directors elected to receive their cash retainers in cash. Commencing on the date of the May 2019 Annual Meeting of Shareholders, all directors elected to receive their cash retainers in cash. The amounts of retainer fees paid in cash, fully-vested stock, and deferred stock units in 2019 are as follows: Mr. Foster received $120,000 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Mr. Jungé received $60,000 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Ms. Owen received $70,000 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Mr. Purgason received $66,250 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Mr. Rackoff received $66,250 in cash, $0 in fully-vested stock, and $0 in deferred stock units; Ms. Rowland received $66,000 in cash, $0 in fully-vested stock, and $0 in deferred stock units; and Mr. Vizi received $60,000 in cash, $0 in fully-vested stock, and $0 in deferred stock units. No director elected to defer cash fees into a deferred cash account. |

3

| On May 23, 2019, each non-employee director serving at that time was awarded an amount of shares of the Company’s Common Stock equal to $75,000 divided by the closing share price per share on the Nasdaq Stock Market on that date, with such shares vesting on the one-year anniversary of the grant date. As with the annual cash retainer fees, under the Director Deferred Compensation Plan, non-employee directors may make an irrevocable election for each Board year (commencing on the date of each Annual Meeting of Shareholders through the following Annual Meeting of Shareholders) to receive, at his or her sole discretion, all of such director’s annual stock award in the form of deferred stock units which would not vest until six months after the respective director’s separation from the Board, subject to the one-year vesting schedule established at grant. Messrs. Foster, Jungé, and Vizi and Ms. Rowland elected to receive their annual stock award, which amounted to 3,076 shares, in deferred stock units. Ms. Owen and Messrs. Purgason and Rackoff received awards of 3,076 shares on the grant date which are only subject to the one-year vesting period. The stock awards are reflected in the “Stock Awards” column of the table and computed in accordance with FASB ASC Topic 718 (excluding the effect of estimated forfeitures). The 2019 annual stock awards of 3,076 shares remain unvested as of December 31, 2019, for each non-employee director. All other stock awards have vested in accordance with their terms. For a discussion of valuation assumptions, see Note 15 of the Company’s Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019. |

TABLE OF CONTENTS

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

The aggregate fees (including out-of-pocket expenses) for professional services rendered by Ernst & Young for 2018 and 20172019 for each of the following categories of services are set forth below:

Audit fees (includes fees for the audit of the Company’s annual financial statements and internal control over financial reporting, reviews of financial statements included in the Company’s quarterly reports, and services that are normally provided in connection with statutory and regulatory filings or engagements, including certain attest engagements and consents) | | | $1,358,000 | | | $1,381,000 |

Audit-related fees | | | — | | | — |

Tax fees (includes tax compliance, tax planning, and state income tax project work) | | | 229,000 | | | 217,000 |

All other fees | | | — | | | — |

Total fees | | | $1,587,000 | | | $1,598,000 |

| | | | |

| | 2017 | | 2018 |

Audit fees (includes fees for the audit of the Company’s annual financial statements and internal control over financial reporting, reviews of financial statements included in the Company’s quarterly reports, and services that are normally provided in connection with statutory and regulatory filings or engagements, including certain attest engagements and consents) | | $1,323,000 | | $1,358,000 |

| | | | |

Audit-related fees | | $0 | | $0 |

| | | | |

Tax fees (includes tax compliance, tax planning, and state income tax project work) | | $219,145 | | $229,000 |

| | | | |

All other fees | | — | | — |

| | | | |

Total fees | | $1,542,145 | | $1,587,000 |

The Audit Committee reviews summaries of Ernst & Young’s services and related fees and concluded that Ernst & Young’s provision of services during 20172018 and 20182019 was compatible with maintaining Ernst & Young’s independence. All Ernst & Young services are pre-approved by the Audit Committee.

Policy for Approval of Audit and Permitted Non-Audit Services The Audit Committee’s policy is to review in advance, and grant any appropriate pre-approvals of (i) all audit services to be performed by the independent auditor and (ii) all non-audit services to be provided by the independent registered public accounting firm as permitted by Section 10A of the Exchange Act, and, in connection therewith, to approve all fees and other terms of such engagement, provided that pre-approval of de minimis services shall not be required to the extent provided by, and subject to the requirements of, the Exchange Act. The Audit Committee will consider annually for pre-approval a list of specific services and categories of services, including audit and audit-related services, for the upcoming or current fiscal year. All non-audit services are approved by the Audit Committee in advance in accordance with the policy on a case-by-case basis. Any service that is not included in the approved list of services or that does not fit within the definition of a pre-approved service is required to be presented separately to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, by other more expeditious means of communication. If the estimated fees for non-audit services are $50,000 or less, management may obtain approval from the Chairman of the Audit Committee in lieu of full Committee action. In 2018,2019, all Ernst & Young professional fees were pre-approved in accordance with the Company’s pre-approval policies then in place.

TABLE OF CONTENTS

The Board, Board Meetings, Independence, and Tenure Since

the 2016,

Annual Meeting, the Board size has been eight

members.directors. During

2018,2019, the Board held

five meetings.six meetings, one of which was telephonic. The Board has determined that all of the directors, except Mr. Robert P. Bauer, qualify as “independent” as defined by applicable Nasdaq Stock Market (“Nasdaq”) rules, considered the independence criteria set forth in the Nasdaq rules as to compensation committee members before determining the independence of each of the members of the Compensation Committee, and also determined that all members of the Audit Committee qualify as “independent” for purposes of the rules promulgated under the Exchange Act specifically related to audit committee member independence. In making these determinations, the Board concluded that none of its directors (other than Mr. Bauer) has a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out a director’s responsibilities.

In its independence review, the Board also considered transactions, relationships, and arrangements between each director or immediate family member and the Company or senior management. The Company’s Corporate Governance Guidelines do not establish term limits that could deprive the Company of the insight developed by Board members over time, but rather provide for periodic reviews of each incumbent’s performance. Additionally, except for special circumstances as may be determined by the Board, since December 2017, no director may be nominated for reelection to the Board if he or she would be age 75 or older at the time of election.

Board Leadership Structure Under the Nasdaq rules, Mr. Foster, Chairman of the Board, qualifies as an “independent” director since his employment with the Company ended on May 27, 2008. The Board has evaluated Mr. Foster’s independence in the same manner as all other directors and strongly believes that he is “independent” and that his economic interests are more closely aligned with those of the Company’s shareholders than with those of management. Although the Board does not necessarily object to combining the roles of Chairman of the Board and Chief Executive Officer (“CEO”), the Board has chosen not to combine those positions because it believes that Mr. Foster’s depth of experience and his detachment from management make Mr. Foster the best qualified individual to serve as Chairman of the Board. Since the Chairman of the Board and CEO roles are not combined, the Board has determined there is no need for a “lead independent director” position.

The Company’s Corporate Governance Guidelines include an expectation that the directors regularly attend shareholders’ meetings. In

2018,2019, each currently serving director attended the

20182019 Annual Meeting of Shareholders.

All of the directors attended 100% of the meetings of the Board and the committees on which they served in

20182019 (to the extent such directors were serving on the Board or such committees at the times of those meetings).

Board’s Role in Risk Oversight The Board is actively involved in overseeing risk management.management including regarding environmental, safety, cyber security, and data privacy programs and practices. Operational and strategic presentations by management to the Board include consideration of the challenges and risks to the Company’s business, which are discussed by the Board and management. The Board also reviews and discusses management reports which specifically address risk topics. The CEO, assisted by senior management, is the “risk officer” responsible for managing and mitigating the Company’s risks.

In addition, each of our Board committees considers risks that are relevant to the areas within its jurisdiction. For example, the Audit Committee periodically requests that management address critical accounting issues and then considers the impact these issues may have on the Company’s financial position and risk profile. The Audit Committee also assesses the adequacy of internal controls. The Compensation Committee develops executive compensation programs with a view toward providing incentives that are aligned with key performance results, without encouraging excessive risks. On an annual basis, the Nomination and Governance Committee oversees risk by reviewing the structure and function of the Board committees.

The Company is committed to promoting the highest standards of environmental performance, corporate governance, and ethical behavior across our global operations while growing our business in a sustainable manner and investing in our people. The Board is responsible for the oversight and monitoring of management’s assessment

TABLE OF CONTENTS

of major risks and strategy for risk management, including performing periodic review of the Company’s environmental and safety programs and practices, Corporate Governance Guidelines, and Legal and Ethical Conduct Policy. The Board is regularly briefed on such matters and visits Company operations at least annually.

The Company has adopted rigorous safety and environmental policies in support of a culture of environmental, health, safety and sustainability (EHSS) excellence that promotes the protection of the environment as well as the safety and health of our employees, business, customers, and communities where we operate. We are committed to meet or exceed the requirements of all applicable environmental, health and safety (EHS) regulations. Among our core values are safety, teamwork, and Innovation which we rely on to create more advanced solutions around sustainability. We will also emphasize continual improvement in our EHS performance, particularly as it applies to preventing pollution and reducing the environmental impact of our operations while maximizing opportunities for environmental and social benefits.

Sustainability is a fundamental component of how we operate, incorporating environmental, financial, and social considerations into our internal risk management analyses. We will continually strive to develop best practices in EHS management based on the internationally recognized standard, ISO 14001:2015. The Company’s EHSS systems are comprised of policies, procedures, and tools used to manage environmental performance in our facilities, including compliance, environmental footprint reduction, and pollution prevention. The system is a framework for setting and reviewing environmental objectives and targets and focuses environmental improvement programs. All facilities globally are required to implement the system, track progress, and perform self-audits.

The Company is committed to:

Minimizing discharges to the air, water, and land;

Promoting environmentally sound management of chemicals and all wastes throughout their lifecycle;

Reducing or eliminating waste through prevention, reduction, recycling, and reuse;

Improving energy efficiency and reducing our greenhouse gas emissions;

Practicing water conservation; and

Reducing impacts to ecosystems by promoting the sourcing of recovered, rapidly renewable, regional, bio-based, and/or environmentally preferable materials.

Human capital management is key to the Company’s success. The Company is an equal opportunity employer and we seek to retain our employees through competitive compensation, benefits, and challenging work experiences with increasing levels of responsibility. The Compensation Committee is tasked with reviewing matters relating to human capital resources, including any human capital measures or objectives that management focuses on in managing the business to address the attraction, development, and retention of personnel, and provide guidance to the Board and management on these matters as the Committee deems appropriate. Management reports to the Board on succession planning, allocation of talent, and alignment of compensation.

Although not part of any formal policy, our goal is to maintain a diverse Board, with directors possessing complementary skills and experiences who together can address the issues which affect our Company.

Communications with Directors Shareholders and other parties interested in communicating directly with the Chairman of the Board or with the non-management directors as a group may do so by writing to L.B. Foster Company, 415 Holiday Drive, Suite 100, Pittsburgh, PA 15220, Attn: Chairman of the Board or Attn: Independent Directors; such parties may also email the Corporate Secretary at corporatesecretary@lbfoster.com. The Corporate Secretary of the Company will review all such correspondence and shall regularly forward to the Board a summary of all such correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deal with the functions of the Board or committees thereof or that otherwise require the Board’s attention. Directors may at any time review a log of all correspondence received by the Company that is addressed to members of the Board and request copies of any such correspondence. Concerns relating to accounting, internal controls, or auditing are referred to the Audit Committee Chair who may direct such matters to the Company’s internal audit department or handle them in accordance with procedures established by the Audit Committee for such matters.

TABLE OF CONTENTS

Historically, the Board has had three standing committees: the Audit Committee, the Compensation Committee, and the Nomination and Governance Committee, each of which is comprised of independent directors, as defined by applicable SEC and Nasdaq rules. Each of the committees has a written charter approved by the Board. In October 2016, the Board created a Strategy Committee and approved a written charter for its

operation.operation, but disbanded this Committee in 2019 as its duties were assumed by the full Board of Directors.

The current members of the Audit Committee are Ms. Owen (Chair), Mr. Rackoff, and Ms. Rowland. The Board has determined that Ms. Owen is an “audit committee financial expert” as defined under applicable rules of the

SEC.SEC and is independent as defined by applicable NASDAQ and SEC rules.

The Audit Committee, which held five meetings during 2018,2019, one of which was telephonic, is responsible for overseeing, with management, the work and findings of the independent registered public accounting firm, as well as the effectiveness of the Company’s internal auditing department and the adequacy of our internal controls and the accounting principles employed in financial reporting.

The Audit Committee also is responsible for the appointment and compensation of our independent registered public accounting firm and for reviewing and, if appropriate, approving transactions with related persons. The Audit Committee’s Charter is posted on the Company’s investor relations website, lbfostercompany.gcs-web.comunder the “Governance” tab.

The current members of the Compensation Committee are Messrs.

RackoffPurgason (Chair), Jungé,

Rackoff, and

Vizi and Ms. Owen.Vizi.

The Compensation Committee, which met on

fourfive occasions in

2018,2019, is responsible for approving executive compensation programs, officer compensation (and submits the CEO’s compensation for ratification by the Board), and equity awards to employees. The Compensation Committee has the authority under its charter to delegate its duties and responsibilities (or functions) to one or more members of the Committee or the Board, or to the Company’s officers, when appropriate, but no such delegation shall be permitted if the authority is required by law, regulation, or listing standard to be exercised by the Compensation Committee as a whole or is otherwise prohibited by law, regulation, or listing standard. The Compensation Committee has delegated authority to the Company’s CEO to grant restricted stock awards under the 2006 Omnibus Incentive Plan (the “2006 Omnibus Incentive Plan”) to non-executive employees in an amount not to exceed 15,250 shares. The Compensation Committee’s Charter is available at the Company’s investor relations website

lbfostercompany.gcs-web.comunder the “Governance” tab.The Compensation Committee currently uses a “Comparator Group” of nineteen similarly-sized companies based on the recommendation of the Committee’s executive compensation

consultant, identified in the “Compensation Discussion and Analysis” section of this Proxy Statement.consultant.

The Compensation Committee has authority to engage consultants, legal counsel, and other advisors, and retained Pay Governance, LLC (the “Consultant”) to provide consulting services on the Company’s executive compensation practices and appropriate levels of, and structures for, executive compensation. The use of a consultant provides additional assurance that our executive compensation programs are reasonable, competitive, and consistent with our objectives. The Consultant is engaged directly by the Compensation Committee, regularly participates, as appropriate, in its meetings, including executive sessions of the Committee that exclude management, and advises the Compensation Committee with respect to compensation trends and best practices, plan design, and the reasonableness of compensation awards. In addition, with respect to the CEO, the Consultant prepares specific compensation analyses for the Compensation Committee’s consideration. The CEO does not participate in the development of these analyses

. The Consultant has served as the Committee’s independent compensation consultant since 2007, and the Committee believes that its Consultant is able to advise the Compensation Committee independent of management’s influence. For information regarding the role of consultant in non-employee director compensation, see “Nomination and Governance Committee.”

For the year ended December 31, 2018,2019, the Consultant provided no services to the Company other than executive compensation consulting services to the Compensation Committee.Committee and the Nomination and Governance Committee as described below. The Compensation Committee assessed the independence of the Consultant pursuant to SEC rules and concluded that the Consultant’s involvement does not raise a conflict of interest. At least annually, the Committee reviews the types of advice and services provided by the Consultant and the fees charged for those services. The Consultant reports directly to the Compensation Committee on all

executive compensation matters;

TABLE OF CONTENTS

regularly meets separately with the Compensation Committee outside the presence of management; and speaks separately with the Compensation Committee chair and other Compensation Committee members between meetings, as needed.

The Compensation Committee gives significant weight to the CEO’s recommendations regarding other executive officers’ compensation; such other executive officers are not present when their compensation is being determined. The CEO is not present when his compensation is being finally determined.

Consideration of Risk Within Compensation Arrangements

In designing incentive plans, the Company attempts to mitigate risk by avoiding unintended compensation windfalls. Attention is devoted to avoiding incentives to engage in excessively risky business behavior.

The Compensation Committee has considered whether other elements of the executive compensation program promote risk taking at levels that are unacceptable to the Company. The Committee considered the following factors related to risk:

•

Compensation philosophy that targets salaries and incentives at the market median;

•

The use of a capital-based performance metric, Return on Invested Capital (“ROIC”), which holds executives accountable for the efficient use of Company capital;

•

Short-term and long-term performance-based incentive awards that are capped;

•

Long-term equity incentives allocated to two separate vehicles (restricted stock and performance share units) with a performance or time vesting period of at least three years in length;

•

The use of a mix of performance metrics in our annual and long-term incentive programs, including ROIC, Working Capital as a Percentage of Sales, Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”) and Compound Annual Growth Rate of Earnings from continuing operations (“Earnings CAGR”);

•

Anti-hedging and anti-pledging policies;

•

Stock Ownership Policy; and

•

Incentive compensation recoupment (“clawback”) provisions.

The Company believes that the above factors, as well as the overall governance and administration of the executive compensation program, serve to manage risk in a manner that is acceptable to the Company and its shareholders and that such compensation policies and practices do not encourage our executives or other employees to take excessive risks that are reasonably likely to have a material adverse effect on the Company.

For more information regarding the Compensation Committee’s processes and procedures for setting executive compensation, see the “Compensation Discussion and Analysis” section of this Proxy Statement.

Nomination and Governance Committee

The current members of the Nomination and Governance Committee are Ms. Rowland (Chair) and, Messrs. Jungé, Purgason, and Vizi.

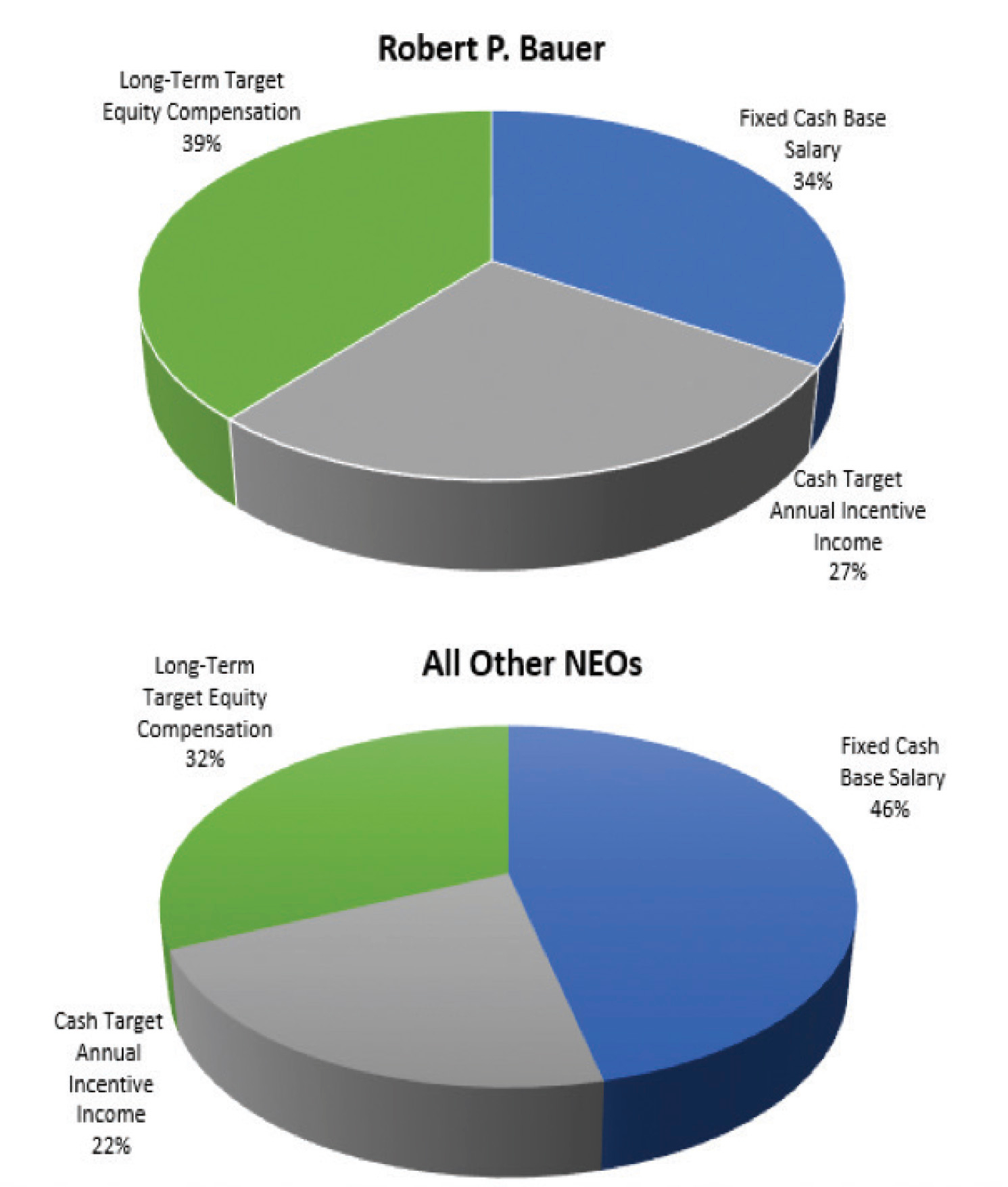

Vizi, and Ms. Owen.The Nomination and Governance Committee, which met on four occasions in 2018,2019, is responsible for overseeing corporate governance, proposing director nominees to the full Board, recommending which directors should serve on various Board committees, and recommending who should serve as Chairman of the Board and chairman of each of the Board’s committees. The Nomination and Governance Committee also recommends to the full Board appropriate compensation for non-employee directors.